Unitization

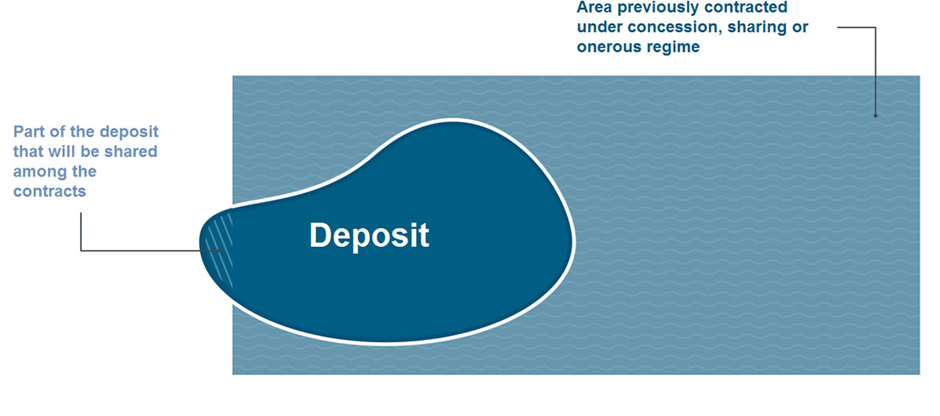

Oil and/or natural gas deposits do not respect the geographical boundaries imposed by man. That is, geology ignores geography. Its limits can go beyond the areas contracted in exploratory auctions and expand beyond the boundaries of blocks, states and even countries (see infographics below).

Originally adopted in the United States and adopted throughout the world, the procedure for individualizing production and the resulting agreements are a reality in Brazil. Production of a deposit that extends by areas of concession, costly assignment or production sharing belonging to different operators or by areas not yet contracted, can be developed in a single project.

These arrangements avoid predatory production of the deposit. It allows costs to be shared among rights holders over the areas. It also allows the investments to be made in the shared deposit to be optimized with regard to the rationality of production and improve the recovery factor of the reservoir. As a result, the economic indicators of the project tend to be maximized.

In the Pre-Salt Polygon and strategic areas, Pré-Sal Petróleo is the company responsible for representing the Federal Government in these agreements. If the project is in the exploratory stage, the Production Individualization Pre-Agreement (Pre-AIP) is entered into. If it is already in the production phase, the Production Individualization Agreement (AIP) is formalized.

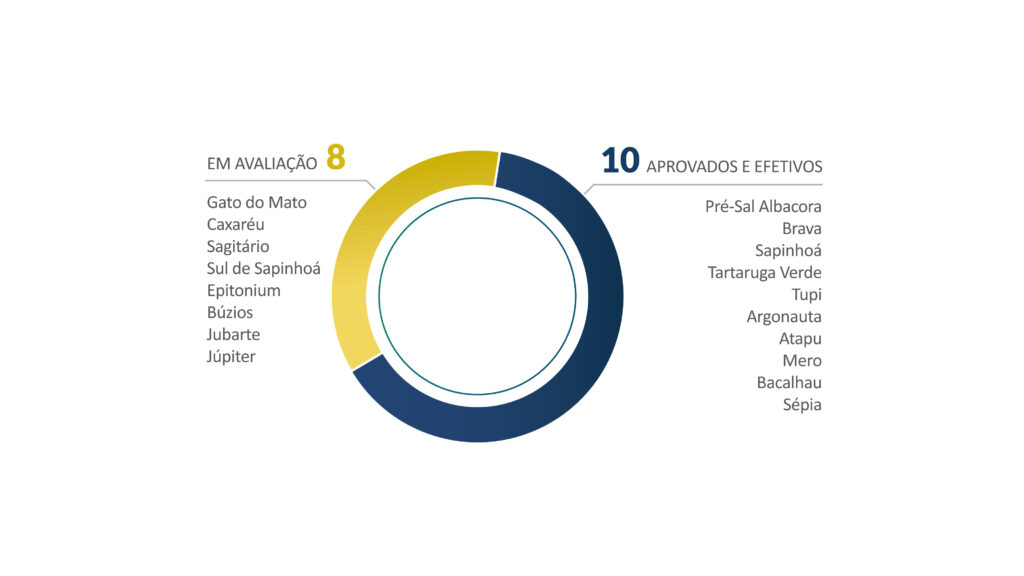

Agreements entered into by Pré-Sal Petróleo

Since its establishment, Pré-Sal Petróleo has already entered into ten Production Individualization. Agreements (AIPs). Eight others potential cases are being assessed . In order to enter into an AIP, there must be a consensus between the parties on the participation and respective volumes of oil and/or natural gas. After the parties have reached a consensus, the consortium and Pré-Sal Petróleo sign the AIP, which becomes effective when made effective by the National Agency of Petroleum, Gas and Biofuels (ANP).

AIPs already signed

Tartaruga Verde Shared Deposit

The Tartaruga Verde Field is located in the Campos Basin, 127 kilometers off the state of Rio de Janeiro coast. The field is operated by Petrobras under concession. It was the first AIP entered into by Pré-Sal Petróleo, creating the Tartaruga Verde Shared Deposit. The agreement was signed on October 31, 2014 and made effective in March 2018.

Tupi Shared deposit

Lula is the main oil and natural gas producing field in the pre-salt reservoirs. Located in the Santos Basin, the block is operated by Petrobras (65%) with partners, Shell (25%) and Petrogal (10%). Negotiations for this AIP began in July 2014 and the agreement was signed in August 2015.

Sapinhoá Shared Deposit

The Sapinhoá Field is an important producer of oil and natural gas. Located in the Santos Basin, it is operated by Petrobras (45%) with partners Shell (30%) and Repsol-Sinopec (25%). The AIP negotiations began in September 2014 and the agreement was signed on January 31, 2016.

Nautilus Shared Deposit

The Nautilius Shared Deposit is part of the BC-10s concession contract in the Campos Basin, where Shell is an operator (50%) and ONGC (27%) and QPI (23%) are partners.

Negotiations for this AIP started in December 2014 and the agreement was submitted to the ANP in November 2015. The AIP has been effective since October 2017.

Brava Shared Deposit

The Brava Field is located in the Campos Basin. The agreement was signed on October 25, 2018, between Pré-Sal Petróleo and Petrobras.

Atapu Shared Deposit

The Atapu Field is located in the Santos Basin. The agreement was signed on October, 2018, between Petrobras, Petrobras, Shell, Petrogal and Total. The start of production of Atapu is forecast for 2020.

Mero Share Deposit

The Mero Development Area (Libra Sharing Agreement) is operated by a consortium formed by Petrobras (40% operator), Shell (20%), Total (20%), CNPC (10%) and CNOOC (10%). The agreement was signed on December, 20, 2018.

Bacalhau Shared Deposit

Bacalhau is located in the Santos Basin, 185 km off the coast of the municipality of Ilhabela/SP, in the state of São Paulo, in a water depth of 2,050 meters.

The agreement establishes the shares of the BM-S-8 Concession Contract (48%) and the Carcará Norte Production Sharing Contract (52%) in the Shared Deposit, as well as the undivided participation of each party in the associated rights and obligations related joint activities. PPSA is the manager of the Northern Carcará Sharing Contract and signs the AIP as the Consenting Intervening Party. The AIP has been effective since January 1, 2022.

Sépia Shared Deposit

The agreement to individualize production from the Sépia Shared Deposit was approved by the ANP in September 2019. Until then, the deposit was made up of the Sépia and Sépia Leste fields, relating to the onerous assignment and concession contracts (BM-S-24) , respectively, operated by Petrobras (97.6%), in partnership with Petrogal Brasil S.A. (2.4%).

At the time of signing, the production sharing contract for excess volumes from the onerous transfer of Sépia, on April 27, 2022, an amendment was signed to the production individualization agreement for the Shared Deposit, which now encompasses the contracts onerous assignment, concession and sharing of production. The AIP has been effective since May 2, 2022. The participation in the Sépia Production Sharing Contract is 60.407%.

Albacora Pre-Salt Shared Deposit

The production individualization agreement (AIP) for the Albacora Pre-Salt (Forno) was approved by the ANP in December 2022, becoming effective one month later. Petrobras is the sole concessionaire of the concession contract for the Albacora Field, arising from the Zero Bidding Round, located in the Campos Basin. On August 14, 2015, Petrobras informed the ANP of the possibility of accumulation extending to the area belonging to the Federal Government, exceeding the southern limit of the concession, thus configuring a possible Shared Deposit.

The Albacora Pre-Salt AIP was signed between Petrobras and the Federal Government on November 30, 2020, granting the Federal Government a 1.67% stake in the shared deposit. Considering that this area was incorporated into the Norte de Brava Production Sharing Contract (CPP), the Federal Government ‘s share is currently determined according to the percentage of Federal Government’s oil surplus established in the Norte de Brava CPP.

Equalization of Expenses and Volumes

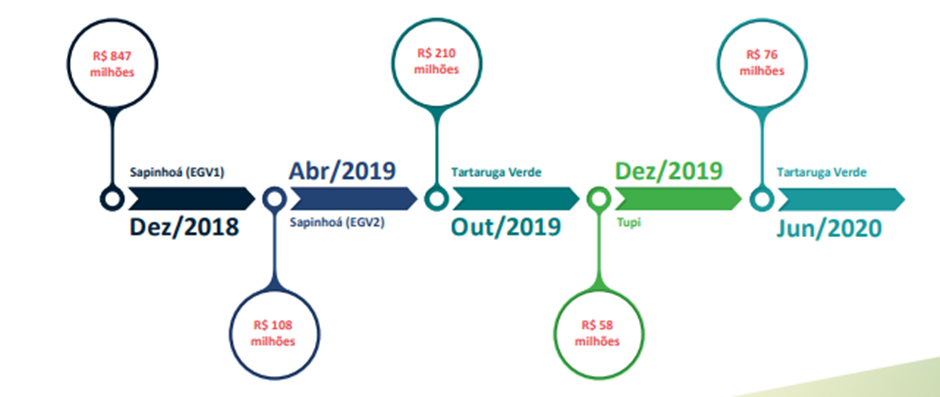

If the ANP authorizes the start or continuity of production from a shared deposit even before approving the AIP, all volumes produced will be appropriated by the holders of the areas under contract, who will also bear the costs incurred. After the execution of the AIP and the definition of its Effective Date, the volumes produced and the expenses incurred must be financially equalized with PPSA. The financial adjustment made after the effectiveness of the AIP is known as Equalization of Expenses and Volumes (EGV).

The equalization calculation considers, in a proportional manner, the difference between the expenses incurred for the production of the deposit and the revenues resulting from the volumes of oil and natural gas, of each party. In the case of the Federal Government, the adjustment considers the amount of revenue arising from production up to that moment, discounted from expenses incurred until the entry into force of the AIP, in proportion to its share.

Equalization already made

- Access the Dynamic Panel of Pré-Sal Petróleo to monitor the collection for the Federal Government with the Equalization of Expenses and VolumesDynamic Panel