Brazil has three legal and tax regimes for oil and natural gas upstream activities: concession regime, sharing production agreement and onerous assignment regime. The sharing production agreement came into effect in the country in 2013 and is only adopted in operations carried out in the Pre-Salt Polygon and strategic areas. Búzios, Itapu, Atapu, Sépia, Sul de Tupi, Sul de Berbigão, Norte de Berbigão, Sul de Sururu and Norte de Sururu blocks have been granted to Petrobras under the onerous assignment regime, against monetary consideration. Under the onerous assignment regime, Petrobras acquired the right to produce up to 5 billion barrels of equivalent oil in such areas.

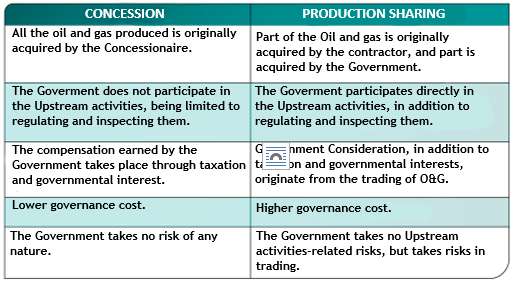

The assignment and sharing regimes differ regarding the model and the Government’s participation. Under concession, all the oil and gas produced is originally acquired by the concessionaire; and the Government does not participate in the activities, being limited to the regulation and inspection thereof. The companies acquire the blocks in auctions held by ANP, competing with each other in the bonus amount offered by the areas and in the offer of exploration activities (minimum exploration program). The compensation earned by the Government takes place through taxation and governmental interest. Other than Brazil, the United States, Canada, Russia, Argentina, Colombia, Mexico, among other countries, adopt this regime.

Under sharing production agreement, the State participates, without investing in or taking the risk, of the upstream activity, other than regulating and inspecting it. In the auction for the offer of areas, the bonus is fixed, and the competition is for the percentage of oil and natural gas production surplus offered to the Federal Government. The bidder that offers the highest percentage of oil surplus to the Federal Government is declared the winner. Since the areas operated in the Pre-Salt Polygon and/or when deemed strategic, are considered of low exploration risk and high potentials, are operated under the production sharing regime, which, in Brazil, is much more strict tax regime than the concession regime. Countries like Russia, India, China, Indonesia, Nigeria, Angola and Kazakhstan work with this regime.

Regime comparison table:

Source: David, Olavo Bentes, Concessão e Partilha: evolução, conceitos, comparativos.

Presentation from lesson taught in FGVV, July/2020

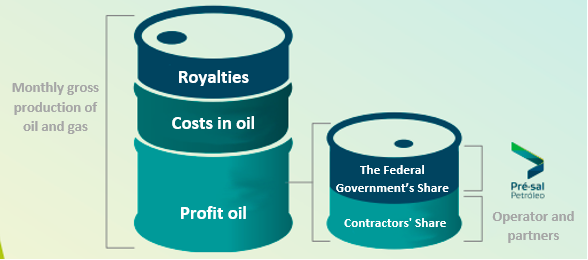

The Federal Government’s share

Under the production sharing regime, the operator and the contractors bear with all the costs of the project and, in case of exploration success, they are reimbursed with a volume of hydrocarbons called “cost in oil”. To calculate the share of oil and natural gas of the Federal Government and the other partners of each project under production sharing regime, the volume corresponding to the royalties payable and every investment and operational expense required for the execution of upstream activities (cost in oil) are deducted from the total production of each field. The difference, called “profit oil”, is distributed among the companies in the consortium and the Federal Government, which shall receive the share of oil surplus offered in the auction.